California Overtime Law (2023)

The US is one of the most progressive and culturally diverse countries in the world. Its tremendous size is distributed across 50 individual states that are all governed by both state and federal laws.

Therefore, each state has characteristic laws depending on its:

- Size,

- Political climate,

- Population, and

- Various industries.

California, the most populous US state, incorporates many state laws that often trump federal law in many areas, including overtime law.

In the following article, we’ll go in detail regarding:

- The correlation between rates and overtime,

- The minimum wage in California,

- Overtime calculations and exemptions, and

- Overtime law, in general, and its intricacies.

General overtime rules in California

In California, overtime is officially counted both after 8 hours of work per day, and 40 hours per week — according to the California Labor Code Section 510, i.e. — The Cunningham Law.

So, for instance, if you work 9 hours on Tuesday, you are entitled to get paid for 1 hour of overtime work.

Or, for instance, if you worked 42 hours in total in the preceding week, you are entitled to get paid for 2 hours of overtime work.

Here's how overtime in California works in more detail.

How do regular rates and overtime rates correlate in California?

The overtime rates in California are based on regular rates. Regular rates are affirmed at the beginning of contractual obligations and they can be either hourly or fixed — salaries.

For hourly employees, regular rates are the rates they get paid per hour during a 40-hour workweek. If they get paid two different rates, overtime is calculated according to the average of the two rates.

For example, if the standard hourly rate during the day is $20 and the shift lasts until the evening when you’re usually compensated $25 (hourly rate during the night), the average hourly rate will be the standard for your overtime rate:

($20 + $25) / 2 = $22.5

For salaried employees, regular rates are calculated by dividing the annual salary by 52 weeks in a year, and 40 work hours in a week, for example:

$30,000 / 52 / 40 = $14.42

How do you calculate overtime in California?

Let's look at a quick breakdown of the overtime rules in California:

| TIME WORKED IN TOTAL | THE OVERTIME RATE |

|---|---|

| > 8 hours in a workday | the regular hourly rate x 1.5 |

| > 40 hours in a workweek | the regular hourly rate x 1.5 |

| the first 8 hours on the 7th consecutive day of work | the regular hourly rate x 1.5 |

| > 12 hours in a workday | the regular hourly rate x 2 |

| > 8 hours on the 7th consecutive day of work | the regular hourly rate x 2 |

So, according to the California overtime law, employers need to pay their employees 1.5 times their regular hourly rate for each hour worked over 8 per day on weekdays and Saturdays.

It’s worth mentioning that the California Labor Codes 551 and 552 prescribe that employees must have at least one day of rest during the week. However, in certain situations, they may need to work the 7th consecutive day in a week.

For this purpose, the first 8 hours an employee works on the 7th consecutive day of work are always counted as 1.5 overtime.

For example, if an employee with a $30 regular hourly rate works 9 hours over 5 weekdays, the employer has to pay $45 for 5 overtime hours (8+1 hours over 5 days).

In total, that amounts to $465 of weekly pay (8 x $30 + 5 x 45$).

Double time overtime requirements in California

Double time pay requirements state that an employer needs to pay employees 2 times their regular rates after 12 hours of work per day.

Moreover, all the time spent working past 8 hours on the 7th consecutive day of work is also to be paid double the regular rates.

For example, this means that an employee with a $30 regular hourly rate working 13 hours for two weekdays will need to be paid $60 for 2 double overtime hours (12+1 hours over two days).

So, once everything is added, the total sum for our proposed week would be the following:

>Weekly pay — 8 x $30 + 5 x 45$ = $465

Weekend pay — 8 x $60 + 8 x $45 + 2 x $60 = $960

Total — $465 + $960 = $1,425

What is the minimum wage in California?

The state of California has its own regulations when it comes to the minimum wage. Namely, if the state minimum wage is higher than the federal one prescribed by the FLSA, it will be implemented as it gives more benefits to California employees.

As of January 1, 2023, due to rising costs and inflation, the minimum wage that California employers will have to pay amounts to $15.50 per hour.

In previous years, businesses that employed 25 or less employees had a lower minimum wage rate than the ones with more workers. However, starting with the year 2023, all rates will be the same for all businesses.

| YEAR | 26 OR MORE EMPLOYEES | 25 OR LESS EMPLOYEES |

|---|---|---|

| 2019 | $12.00 | $11.00 |

| 2020 | $13.00 | $12.00 |

| 2021 | $14.00 | $13.00 |

| 2022 | $15.00 | $14.00 |

| 2023 | $15.50 | $15.50 |

Some states count tips employees receive towards minimum wages. This is not the case in California, where tips are NOT counted towards the minimum wage.

In addition to California's overall higher minimum wage (the official US minimum wage according to the federal law is $7.25), some California jurisdictions also have their own local minimum wages per hour (effective January 1st 2023):

- $15.97 — Oakland,

- Around $16-17 — Berkeley, Cupertino, El Cerrito, Los Altos, Milpitas, Palo Alto, San Francisco, San Jose, San Mateo, and Santa Clara,

- $18.15 — Mountain View and Sunnyvale, and

- $17.48 — Emeryville.

California overtime calculator example

For example, an employee with a $20 regular hourly rate may have the following weekly salary breakdown:

- Regular hourly rate: $20

- 1.5 overtime rate: 1.5 x $20 = $30

- Double overtime rate: 2 x $20 = $40

- Sunday is treated as the 7th consecutive day of work

| Hours worked | Regular hours | 1.5x overtime | Double overtime | Pay calculations | Total pay for the day | |

|---|---|---|---|---|---|---|

| Monday | 9h | 8h | 1h | / | (8h x $20) + (1h x $30) | $190 |

| Tuesday | 13h | 8h | 4h | 1h | (8h x $20) + (4h x $30) + (1h x $40) | $320 |

| Wednesday | 8h | 8h | / | / | (8h x $20) | $160 |

| Thursday | 8h | 8h | / | / | (8h x $20) | $160 |

| Friday | 10h | 8h | 2h | / | (8h x $20) + (2h x $30) | $220 |

| Saturday | 8h | / | 8h | (8h x $30) | $240 | |

| Sunday | 11h | / | 8h | 3h | (8h x $30) + (3h x $40) | $360 |

| Total | 67h | 40h/$800 | 23h/$690 | 4h/$160 | TOTAL PAY FOR THE WEEK: $1,650.00 |

Employees may need to carry out these calculations if they fear they are owed some back-dated overtime pay.

If you're an employee, you can carry out these calculations manually, by using this calculation layout as a guide.

Or, you can use an overtime calculator, for a faster and more precise turnaround:

➡️ California overtime calculator (spreadsheet)

What is California Labor Code 511?

There are some sections of the California overtime law that treat the matter of overtime differently.

According to the California Labor Code Section 511, an employer may require the employees to work more than 8 hours per day as a norm.

Namely, they may schedule 10-hour shifts for 4 days in a week. In such a case, employees are NOT entitled to be paid 1.5 overtime for the 2 extra hours, considering that they are not expected to work only 8 hours in the first place. Moreover, they are still working no more than 40 hours per week.

However, the employer will first need to present the case for such an alternative workweek in front of a readily identifiable work unit.

If they work up to 12 hours per day during their 10-hours shifts, they are entitled to be paid 1.5 times their regular hourly rates for those 2 extra hours. On the other hand, if they work more than 12 hours, they are eligible for double overtime pay.

Everything you need to know about the 4-day workweek concept

Who is exempt from overtime in California?

According to the FLSA, non-exemptemployees are entitled for overtime compensation, while exempt employees are not.

Furthermore, according to the California Labor Law, employees are exempt if they:

- Get paid a monthly salary of no less than 2 times the California minimum wage,

- Are engaged in specific fields of work: creative, intellectual, or managerial,

- Are engaged in work that requires discretion, and

- Are engaged in work that requires independent judgment.

Apart from these conditions, there are certain types of professions that are always usually counted as exempt:

- Commissioned employees,

- People working in administration,

- Executives,

- Computer professionals paid on an hourly basis,

- Teachers in private schools,

- Outside salespeople,

- Truck drivers,

- Physicians, and

- Surgeons.

In addition to this list, union employees are also not eligible for 1.5 and double overtime — but, that's because their unions usually prescribe different overtime rates — usually $3.30 per overtime hour.

Unless the employer is absolutely certain that the employee should be classified as exempt (in accordance with all the said rules), the employee in question must be classified as non-exempt.

For a more detailed overview regarding overtime exemptions, you can refer to the Department of Industrial Relations' website

Do salaried employees receive overtime in California?

It depends on whether they're classified as exempt or non-exempt from the Federal Labor Standards Act.

Usually, non-exempt employees are the ones paid by the hour. But, some salaried employees may also be non-exempt:

- Non-exempt salaried employees ARE entitled to get paid overtime, and

- Exempt salaried employees are NOT entitled to get paid overtime.

If salaried employees are getting paid at least twice the minimum hourly wage for a 40-hour workweek, they are exempt from getting paid for overtime. However, if they're not getting paid as much, they cannot be exempt from overtime.

In numbers, that amounts to $58,240 per year, for companies with more than 25 employees — 2 x $14 (minimum wage) x 40 hours per week x 52 weeks per year.

For companies with 25 or fewer employees, that amounts to $54,080 per year — 2 x $13 x 40 hours per week x 52 weeks per year.

So, if you currently make less than $58,240 or $54,080 per year, you qualify as a non-exempt employee entitled to be paid overtime — unless you fall under exempt employees based on your position at work or choice of profession.

Salary vs hourly employment: pros and cons

Overtime law changes in California — flat bonuses

The new overtime law in California is tied to calculating employee weekly pay based on flat bonuses they receive for overtime.

The following new law was established after the ruling in the Alvarado v. Dart Container Corp. of California case. The case was caused by a dispute in the amount employees in Dart Container Corp. were supposed to receive as a bonus for completing their weekend shifts.

To explain the new law (and its difference with old practices), let's take the following numbers for our example calculations:

- $25 hourly rate,

- 50 hours worked in total, and

- A flat bonus of $200 as a base.

Dart Container Corp. total pay calculations

Dart Container Corp. used the federal formula to calculate the weekly pay of employees — based on the total number of hours worked.

They calculated the regular pay rate by multiplying the regular rate per hour with the total number of hours worked per week:

- $25 x 50 = $1,250

Then, they added this weekly amount to the received bonus, and divided it by the number of total hours worked:

- ($1,250 + $200) / 50 = $29

According to the FLSA and the overtime rate for the employee ($29 x 1.5 = $43.5), the employee would then be entitled to an amount of $1,595 for that week (40 x $29 + 10 x $43.5).

However, that turned out to be a legally problematic calculation.

Pay rates 101: Understanding how pay is calculated in the workplace

Alvarado's total pay calculations

The other party in the case, Hector Alvarado, complained that the Dart Container Corp. was underpaying its employees because it wasn't following the California's Division of Labor Standards Enforcement (DLSE) Manual.

According to Alvarado (and the said Manual), Dart Container Corp. should have used only the number of non-overtime hours worked for the divisions, and not the total.

If we take the same numbers from the previous example, that means $1,450 (weekly pay plus bonus) should be divided by 40 and not 50:

- ($1,250 + $200) / 40 = $36.25.

So, a regular rate is $36.25.

Which amounts to $1,993.8 of total weekly pay owed:

- $36.25 x 40 = $1,450 — regular rate compensation

- $54.38 x 10 = $543.8 — overtime rate compensation

- $543.8 + $1.450 = $1,993.8 — total

The ruling of Alvarado v. The Dart Container Corp. of California case was added to the California overtime law — and all overtime based on flat-bonuses should be calculated accordingly.

What else do you need to know about overtime in California?

Here are some additional overtime information in California that might be of use to you:

- Under certain circumstances, it may be illegal to prescribe mandatory overtime (even when it's properly paid),

- The employee's right to collect overtime pay cannot be waived,

- The amount the employees collect for overtime — 1.5 times more for >8 hours and 2 times more for >12 hours — cannot be waived,

- Commute time doesn't count towards regular work time or overtime,

- Travel time for merchandisers counts as work time, except the time they commute to and from their homes,

- Time spent traveling for business may count towards overtime — if it makes the employee accrue more than 40 work hours per week or 8 hours per day (such as conferences, seminars, sales meetings, and trainings),

- If the employer knows the employee is working overtime, even if this time is not officially specified in the timesheet, the employee is still entitled to be paid for this overtime,

- The California law does not require the employees to work more than 72 hours per week — i.e. they CAN legally refuse to work more than 72 hours during a week without being sanctioned by their employers,

- Paid rest breaks ARE included when calculating overtime (employees in California are entitled to 10-minute breaks after every 4 hours of work, and 30-minute breaks after every 5 hours), and

- On-call time may count towards overtime if it makes the employee accrue more than 40 hours of work per week or 8 hours of work per day.

How to track overtime hours in California?

As we’ve seen, California has an abundance of laws that make it quite difficult to track overtime, especially if you plan on doing mental math. Luckily, modern software has advanced to the point where there’s no need to do anything on your own.

Nowadays, all you have to do is input the variables, such as hours worked and the amount of your hourly wage, and time tracking software will do the rest for you.

Our recommendation? Try Clockify and see what the buzz is all about.

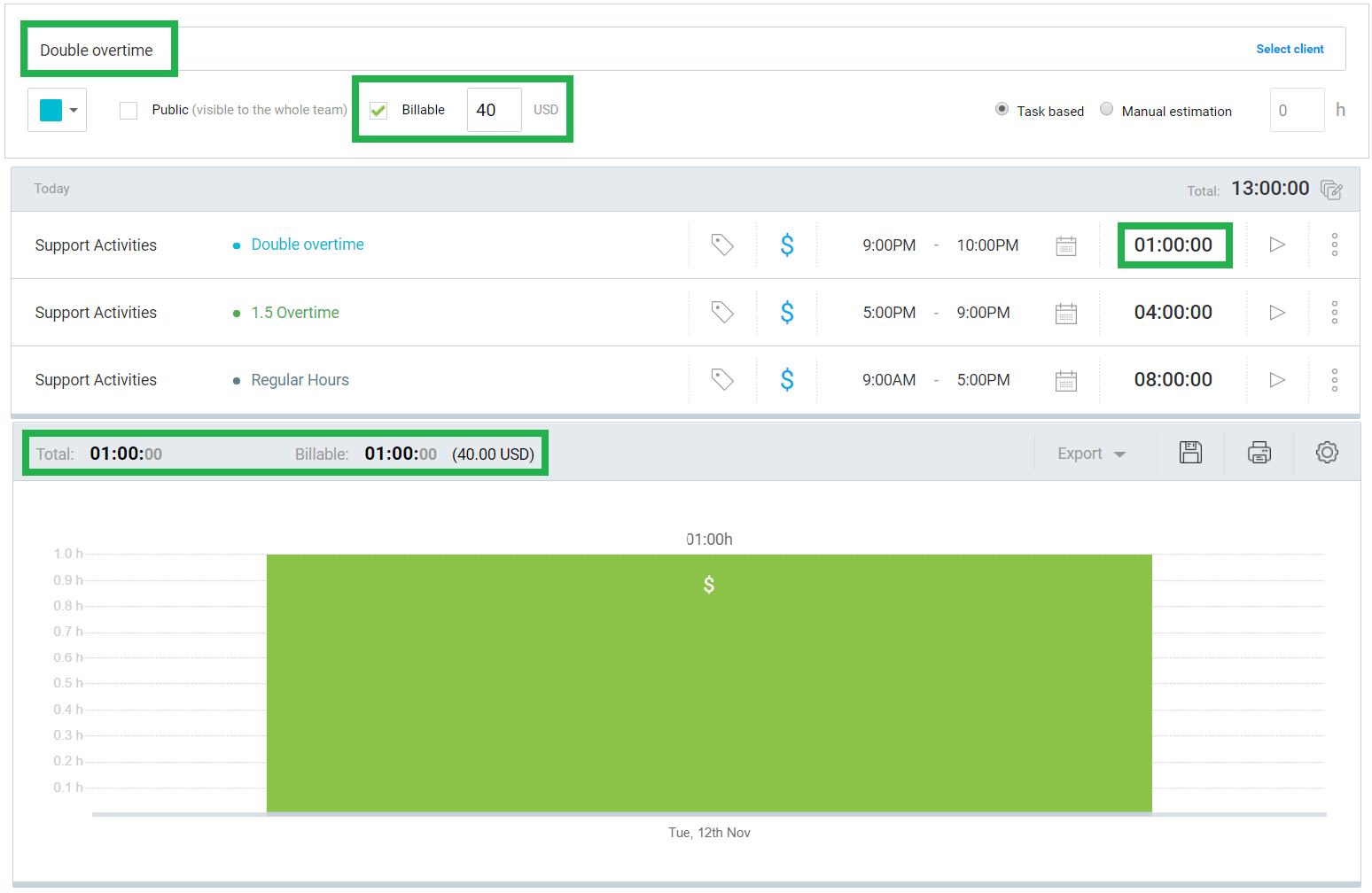

Tracking overtime with Clockify

Clockify helps you track the time you spend on individual tasks and projects — both regular hours and overtime.

To have your pay automatically calculated based on your hours worked, all you need to do is specify your hourly rates and mark each time entry you make for work during work hours as billable. Then, you'll be able to view your earnings in the Reports section of the app.

How to calculate billable hours

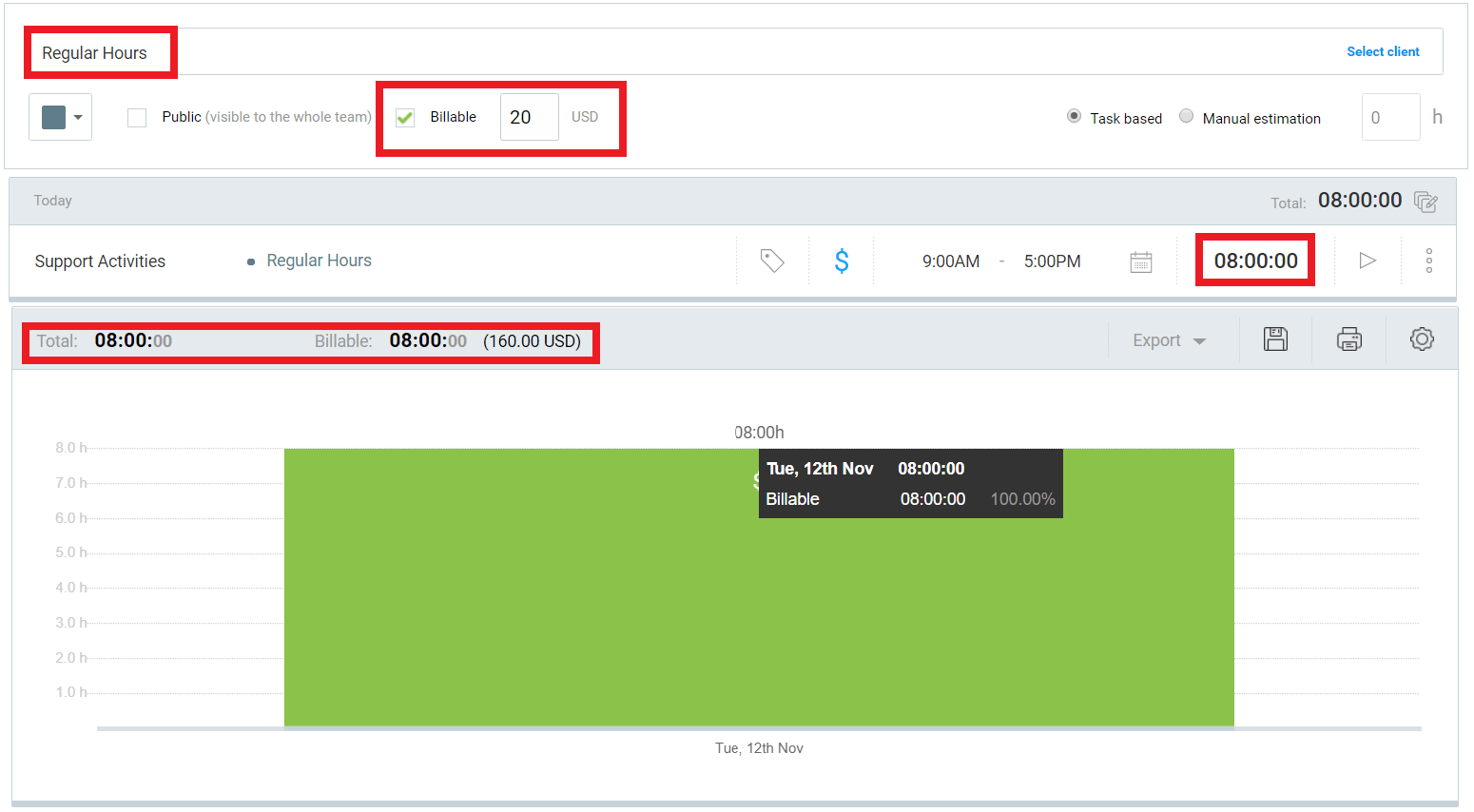

Let's see how tracking overtime works if you have a regular rate of $20 per hour, for instance.

For this purpose, we'll need to create 3 projects:

- One for your regular hours,

- One for your 1.5 overtime, and

- One for your double overtime.

First, create a project for your Regular Hours, and define your regular hourly rate for it ($20). Here, you'll be tracking your first 8 hours per day.

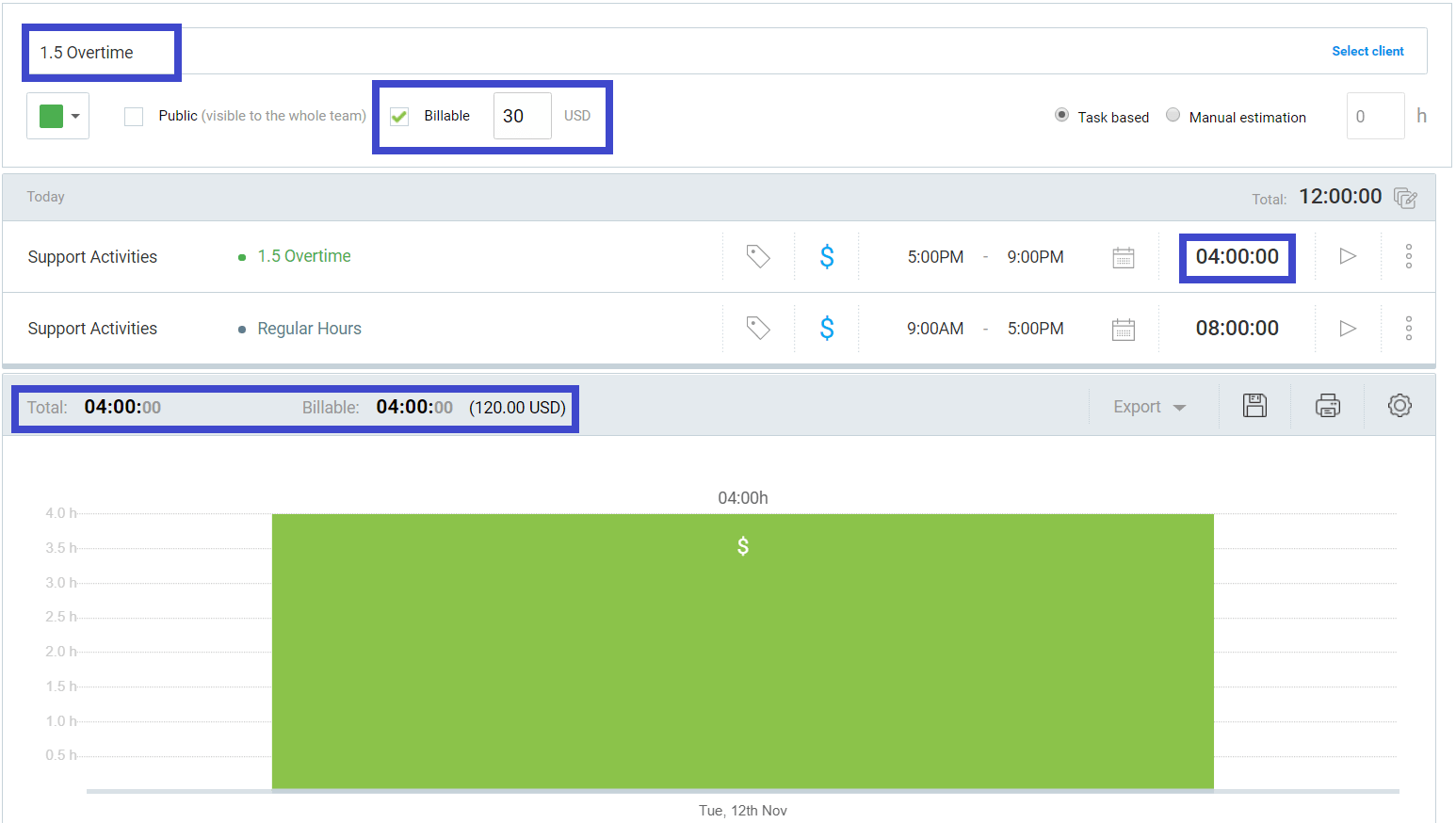

Then, create a separate project for your 1.5 overtime, and define your 1.5 overtime hourly rate (1.5 x $20 = $30).

Here, you'll be tracking the time you spend working past 8 hours per day, but less than 12 hours per day, and the first 8 hours you spend working on the 7th consecutive day of work.

Next, create a separate project for your Double Overtime, and define your 2 overtime hourly rate (2 x $20 = $40).

Here, you'll be tracking the time you spend working past 12 hours per day, and all time spent working past the first 8 hours on the 7th consecutive day of work.

As an alternative to tracking time in real-time in the Time Tracking page, you can also add time manually on the same page, or add it manually in the app's timesheet page.

For the purpose of adding time manually in the timesheet, you can select the same 3 projects you've previously created.

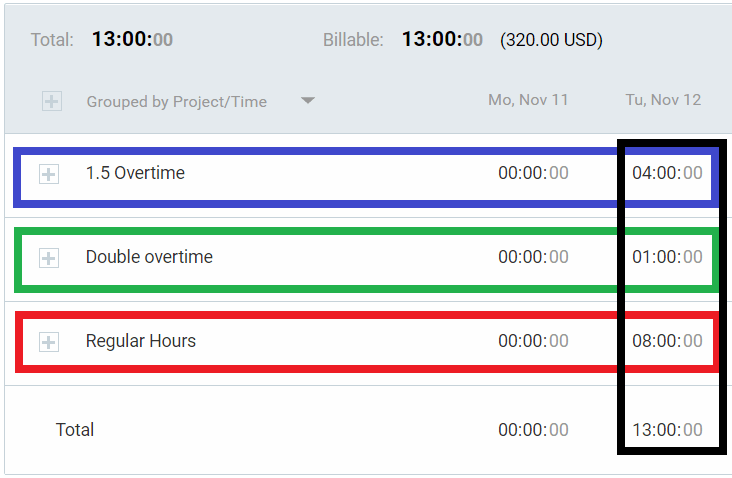

Managing the overtime tracked with Clockify

After adding your time for that week, you can run regular Visual Reports to see how much time you've spent working overtime and regular hours for the whole week.

After all, you don't want to overwork yourself to burnout or realize that you're working more than what your body and mind are allowing you to.

This way, you'll also get a comprehensive breakdown of your work hours and pay.

Career burnout and its effect on health

You can further classify your time entries in Clockify with:

- Tags,

- Projects,

- Clients, and

- Tasks.

However, if you're just looking to calculate your overtime hours and pay in general for each day, the first 3 steps will always be more than enough.

You'll get your regular, 1.5 overtime, and double overtime hours calculated according to California overtime law — fast and with complete precision.

References:

State of California, Department of Industrial Relations, Labor Commissioner’s Office, https://www.dir.ca.gov/dlse/

California Legislative Information, Labor Code Search,

https://leginfo.legislature.ca.gov/faces/codes_displaySection.xhtml?sectionNum=511.&lawCode=LAB