The 17 best payment apps

Last updated on: October 30, 2023

So, you’ve made arrangements with your client about the project requirements and deadlines in order to ensure that the client is satisfied and the project is fully functional — but, how do you ensure you get paid in the end?

A good payment software should make accepting payments easier.

We’ve explored some of the most used payment processors in terms of:

- Payment processing time,

- Fees,

- Country availability,

- Currencies available,

- Payment methods,

- Transfer limits, and

- Notable features, including pros and cons for each app.

After researching dozens of apps in terms of all the aforementioned features, we picked out 17 popular payment processors for small businesses and freelancers.

Table of Contents

PayPal — best for small businesses and freelancers

PayPal is an online payment system with over 200 million users. This payment platform allows you to:

- Create an account on the PayPal website,

- Connect your credit card,

- Receive payment from clients, and

- Withdraw money from your PayPal balance.

PayPal payment processing time: 3–5 business days

PayPal fees:

- Sending international personal transactions depends on the following:

- Where the money is being sent from,

- Where the money is being sent to, and

- The method of payment.

For example, if you’re sending money from Andorra to Canada, using your bank account — the fee will be € 1.99.

Country availability: Available in over 200 countries. However, not all countries can receive payments, some can only send them. So, before opening a PayPal account, make sure to check the eligibility of your country here.

Currencies: Available in 25 currencies

Payment methods:

- Bank transfer,

- PayPal Debit Mastercard,

- Requesting a check,

- PayPal balance, and

- Paypal credit and reward balance.

Transfer limit: Up to $10,000 per transaction

Notable features:

- Barcode and QR scanner,

- Online invoicing,

- Virtual Terminal, and

- Trading with cryptocurrencies.

| PayPal pros | PayPal cons |

|---|---|

| – Safe way to send and receive payments – Integrated security measures – Variety of financing methods | – Inadequate customer service – Conflicts might cause refunds to be delayed – Commonly used as a phishing and scam target |

💡 Clockify Pro Tip

If you’re looking for an easy solution to online invoicing, apart from PayPal, you can also try efficient tools that focus solely on invoicing — to make your pick, check out our list of free invoicing tools:

Payoneer — best for people looking for PayPal alternatives

Payoneer is one of the more popular PayPal alternatives with more than 4 million users. This payment solution lets its users receive and make online payments in a couple of clicks, as well as track their account balance and entire transaction history. Payoneer is also one of the best choices if you’re looking for a way to receive payments online for free.

Payoneer payment processing time: 2–5 business days

Payoneer fees:

- $1.50 if you want to transfer funds from Payoneer to your local bank, up to 2% to transfer funds from a foreign currency, and

- 3% for credit card payments or 1% for ACH of the amount you receive for USD and EUR transfers (fees cannot exceed $10).

Country availability: Accepted payment method in 200+ countries.

Currencies: Available in 150+ currencies

Payment methods:

- Bank Transfer,

- MasterCard,

- local eWallets, and

- International checks.

Transfer limit: Payoneer cardholders can withdraw up to $5,000 per day (up to 30 separate ATM withdrawals per day)

Notable features:

- Single and mass payout,

- Integrated payments, and

- No regular bank account needed — you get a virtual account in a US bank.

| Payoneer pros | Payoneer cons |

|---|---|

| – Free-of-charge transfers between Payoneer accounts – Customized invoices and requests for payments from specific clients – Extensive customer support system by phone, email, and live chat service | – Expensive card fees – For overseas transactions, a 0.5% currency conversion fee is applied – Annual fee to use Mastercard |

Cash App — best for US and UK transfers

Cash App (also known as Square Cash and Square Cash App) is a mobile payment platform that enables users to transfer money by using their mobile phones alone. This payment solution is compatible with both Apple Pay and Google Pay.

Cash App payment processing time: Immediate transfer (0.5%–1.75% fee), or 1–3 business days

Cash App fees:

- 0.5%–1.75%, for instant deposits.

Country availability: United States and the United Kingdom.

Currencies: The country of your account determines your currency, and cannot be altered (for a new currency, you’ll need to open a new account).

Payment methods:

- Debit Visa card (also known as the Cash Card), and

- Bank Transfer.

Transfer limit:

- Unverified accounts can send up to $250/week and receive up to $1,000/month, and

- Verified accounts can send up to $7,500/week and $17,500/month, and there is no limit to how much you can receive.

Notable features:

- Bitcoin trading,

- Sending money using Siri (on iPhone), and

- An advanced fraud detection infrastructure.

| Cash App pros | Cash App cons |

|---|---|

| – It’s free and easy to use – Offers federal and state tax filing tools – Simplified reimbursement processes – Offers commission-free stock investing | – Low limit for the first 30 days – Lacks Federal Deposit Insurance – Company coverage |

QuickBooks — best for those who wish to also do their accounting

QuickBooks is essentially an accounting software, but it can also help you receive payments online. This tool lets you:

- Send out invoices,

- Schedule recurring payments,

- Accept payments, and

- Record all changes made to the software.

QuickBooks payment processing time:

- Credit card payments: 2–3 business days, and

- ACH transfers: 5–7 business days.

QuickBooks fees:

There are several monthly payment plans to choose from + transaction fees of 1% (but no more than $10) per ACH transfer, but there’s also:

- 2.4% + $0.25 per swiped card transaction,

- 2.9% + $0.25 per digital invoice card transaction, and

- 3.4% + $0.25 per keyed-in card transaction.

Country availability: Available globally. For a full list of countries check out this list.

Currencies: Available in 150+ currencies

Payment methods:

- Credit Card,

- Debit Card,

- ACH Bank Transfer,

- PayPal, and

- Venmo.

Transfer limit: Depends on your processing volume (i.e. the amount of money transferred within your account in the last 30 days)

Notable features:

- Online invoicing,

- Scheduled recurring payments, and

- The option to invite your accountant to partake in your transactions.

| QuickBooks pros | QuickBooks cons |

|---|---|

| – Sending invoices is straightforward – Simple-to-use tax reports for the end of the year – Extensively used by accountants and bookkeepers – Offers easy finance monitoring | – Subscription is costly – Customer support is limited |

💡 Clockify Pro Tip

Apart from its role as a payment processor, QuickBooks online mainly serves as an effective automated accounting software — for more tools like QuickBooks, check our list of best accounting tools:

Google Pay — best for smartwatch owners

Whether you’re a small-business owner or a freelancer, Google Pay allows you to receive payments for free, from your mobile or desktop device. To be able to make the most out of this payment platform, your clients just need to enter your email address or phone number to send you the money. Once you create an account, you get a PIN number you’ll use to manage all transactions.

Google Pay payment processing time: 3–5 business days

Google Pay fees:

- A 2.9% fee for Credit cards.

Country availability: Available in 75 countries overall (currently banned in Russia). Also available on watches that support Google Pay for the United States, Australia, Canada, France, Germany, Italy, Poland, Russia, Spain, and the United Kingdom.

If you want to send money to your friends and family, you can use Google Pay to send it in the US, India and Singapore.

Currencies: Available in 100+ currencies

Payment methods:

- Debit card,

- Credit Card, and

- PayPal.

Transfer limit:

- For a 7-day period:

- Users with verified identity: $20,000,

- Users with unverified identity: $700.

- For a single transaction:

- Users with verified identity: $5,000,

- Users with unverified identity: $700.

- In order to claim transactions that are over $2,500, you’ll need to have a bank account connected to your Google Pay account.

Notable features:

- Integration with other Google services,

- Analytics for traffic, affinity, and engagement related to your brand, and

- Claiming your money through SMS, by requesting a link.

| Google Pay pros | Google Pay cons |

|---|---|

| – Easy to use – Enhanced security – Compelling incentive and promotional schemes | – Not supported on phones that don’t have NFC functionality, that allows money-sharing between an NFC tag and an Android device or between two android devices |

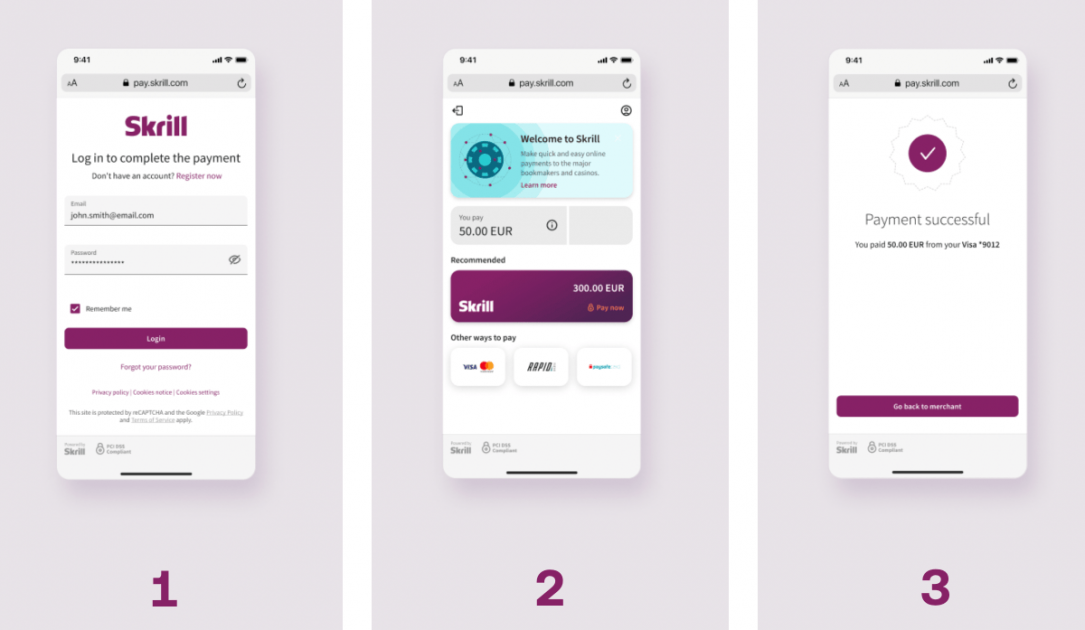

Skrill — best for simple money-managing

Skrill is an online payment processor that allows you to make international money transfers at a low cost.

Skrill payment processing time: Up to 3 days for the Skrill review team to approve the transfer (depends on several factors, such as the payment method and the country you’re transferring money to).

To have the payment transferred to your account, you’ll have to wait up to two working days. There are several factors that influence the waiting time:

- The sender’s country,

- The receiver’s country, and

- Payment methods available in the receiver’s country.

An instant transfer is possible only with Skrill-to-Skrill transactions.

Skrill fees:

- Skrill doesn’t charge anything when it comes to receiving the money — however, you might be charged a currency conversion fee of 3.99% for Skrill’s exchange rate.

Country availability: Skrill is globally available, except for a smaller number of countries you can find in this list.

Currencies: Available in 39+ currencies

Payment methods:

- Bank transfer,

- Credit card,

- Debit card, and

- Digital eWallet.

Transfer limit:

- Minimum: $10 (or the equivalent amount),

- Maximum: $10,000 (or the equivalent amount).

Notable features:

- Email transactions,

- Improved fraud management, and

- Over 100 local payment methods over the world.

| Skrill pros | Skrill cons |

|---|---|

| – Skrill offers personal and business accounts – It’s a safe platform, monitored by the Financial Conduct Authority – Prepaid card that is simple to activate – Easily accessible through web browsers and can be found on Google Play Store and App Store | – Limited customer service |

Venmo — best for peer-to-peer transactions

Venmo is a digital wallet (owned by PayPal) that lets you transfer funds online or via a Venmo app. The platform also includes a feed that resembles regular social media feeds where you can comment on transactions for your friends to see.

Venmo payment processing time: Instant (includes a 1.75% fee, but no more than $25), or up to 3 business days

Venmo fees:

- 1.75% of the transferred amount for the Instant transfer option (the lowest fee is $0.25, and it cannot exceed $25)

- 3% of the transaction every time you use a credit card, and

- Sending money via bank transfer, debit card or your Venmo balance is free of charge.

Country availability: Only available in the US — international transfer is not supported.

Currencies: United States Dollar (USD)

Payment methods:

- Credit Card,

- Debit Card,

- Bank account, and

- Venmo balance.

Transfer limit:

- Up to $999.99 per week for unverified accounts,

- Up to $19,999.99 per week for verified accounts, and

- $5,000 if you’d like to transfer a single largest amount.

Notable features:

- Bill sharing (for projects with multiple clients who’ll need to share your bill), and

- Users can share how satisfied they are with your purchases on the Venmo feed and increase the distribution of your brand.

| Venmo pros | Venmo cons |

|---|---|

| – Easy online shopping and sending/receiving money process – Depositing checks – Optional debit and credit cards (which include a cash-back option) – Early direct deposit to your account | – Money transfers are not insured by FDIC Available only in the US |

Dwolla — best for ACH transactions

Dwolla is a US-only online payment and mobile payment system that’s best at ensuring easier ACH payments.

Dwolla payment processing time: Typically 3–4 business days

Dwolla fees: Dwolla charges 0.5% fee per transaction

Country availability: US

Currencies: United States Dollar (USD)

Payment methods: No Credit or Debit Cards, Dwolla connects directly to your Bank account in order to reduce costs.

Transfer limit: Generally speaking, there are no limits when it comes to the amount you can receive. However, there are limitations that apply to the amount you’re allowed to send.

Here are sending limits based on the customer type:

- Business verified — $10,000/transfer,

- Personal verified — $5,000/transfer, and

- Unverified customer — $5,000/week.

Companies can perform ACH transactions as high as $1 million ACH transactions per day, with the feature Same Day ACH.

Notable features:

- Mass payments,

- A dashboard meant to help you manage customers, as well as analyze transactions and insights, and

- On-demand bank transfers that allow you to collect your payments from the clients’ bank accounts (as long as you give the client permission to do so).

| Dwolla pros | Dwolla cons |

|---|---|

| – Cheap transaction costs – White-label payment option | – No credit cards |

Authorize.net — best for small businesses with merchant accounts

Authorize.net is a payment processing and management platform that allows you to easily accept payments via checks and credit cards online.

Authorize.net payment processing time: Usually within 24 hours

Authorize.net fees:

- Within the All-in-one plan — $25 per month for gateway fees, plus a 2.9% + $0.30 fee per transaction, and

- Within the Payment gateway-only plan — $25 per month for the gateway, plus a $0.10 per transaction + $0.10 fee for daily batch.

Country availability: Available in the US, UK, Australia, and Canada

Currencies: Available in 12 currencies

Payment methods:

- Visa,

- MasterCard,

- PayPal,

- Visa Checkout,

- E-checks,

- Apple Pay, etc.

Transfer limit:

- A $5,000 limit for the monthly volume, and

- A $100 for the maximum size per transaction.

Notable features:

- An Authorize.net verified seal for merchants,

- Accept mail and telephone order payments, and

- Advanced filters for fraud detection.

| Authorize.net pros | Authorize.net cons |

|---|---|

| – Strong security and fraud detection – Billing monthly – Cost-effective flat rates – Excellent client service | – $25 monthly added fee – Customer service needs improvement |

Xero — best for PayPal and Stripe users

Xero is essentially an accounting software, but it also allows you to accept payments indirectly, by connecting the software with popular payment processors such as PayPal and Stripe.

Xero payment processing time: Usually 2–10 business days

Xero fees: Between 2% and 4% of an invoice value

Country availability: Available globally

Currencies: Available in 150+ currencies

Payment methods:

- Credit cards,

- Debit cards, and

- Bank account.

Transfer limit: Depends on the Xero plan you’re using, but usually up to 2,000 transactions per month.

Notable features:

- Financial reporting and inventory reports,

- The option to attach files to financial data, and

- Bank reconciliation.

| Xero pros | Xero cons |

|---|---|

| – Cloud-based with user-friendly interface – Safe and secure 30-day free trial (cancel any time) – Simple third-party integration | – Customer support not available over the phone – Low number of invoices if you choose the Early plan |

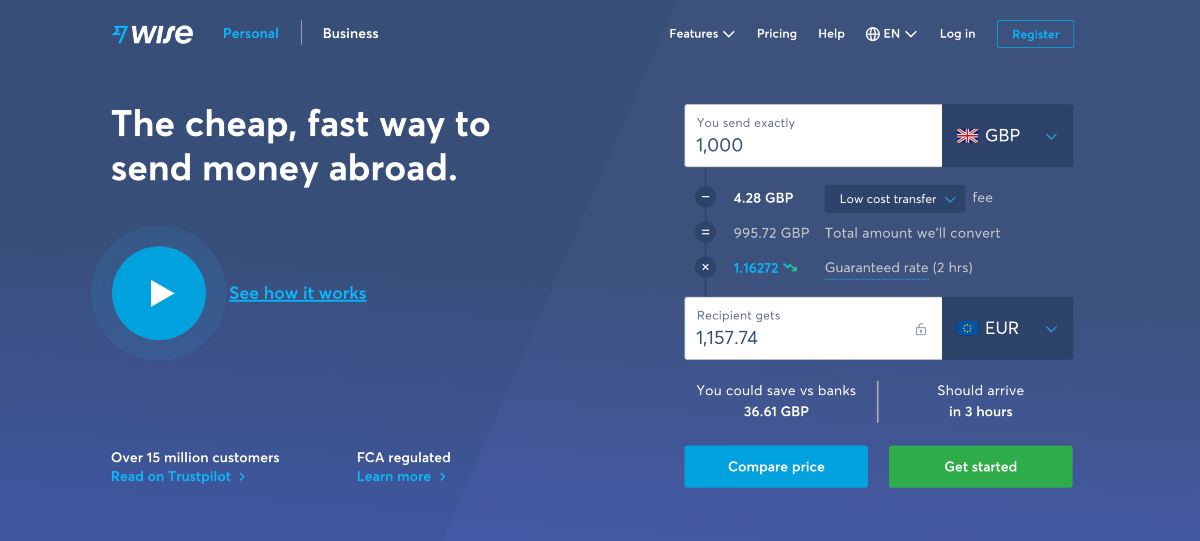

Wise — best for those who wish to avoid border-crossing fees

Wise, formerly known as TransferWise, is an international transfer service that lets you carry out transactions by matching your transfers and taking a small commission fee. There are no border-crossing fees for international transfers because the money doesn’t travel internationally — it just travels from one Transferwise account to another.

Wise payment processing time: Depends on the currencies, countries, amounts, and payment methods involved. It could take a few seconds to five business days.

Wise fees: Also depends on the countries, currencies, and amounts involved. You can calculate your specific Wise fees here. Also, keep in mind that if you decide to order a card, you will be charged $9.

Country availability: 40+ countries

Currencies: You can receive transactions in 55 currencies. However, there is a catch — you cannot send and receive the same currency (the currency exchange process is mandatory), and you can only receive the official currency of your country (for example, you can only receive Canadian Dollars in Canada).

Payment methods: Yet another aspect that depends on the countries, currencies, and amounts involved. Bank transfers, Direct debit, Visa cards, Mastercards, wire transfer, Apple pay and some Maestro cards are all an option.

Transfer limit: Limit depends on currencies, amounts, and payment methods. In general terms, the limitations are:

- ACH transactions — $15,000/day,

- Debit/credit card transactions — $2,000/day or $8,000/week,

- Local bank transaction — $1 million, and

- SWIFT transfer — $1,6 million.

Notable features:

- Recurring transfers with recurring senders and recipients for multiple projects (and payment deadlines) for the same client,

- The option to send personal verification documents, and

- A personalized Wise card for payments.

| Wise pros | Wise cons |

|---|---|

| – Mid-market exchange rate – There are no hidden costs – User-friendly interface and money-transfer service | – Customer support needs improvement – Sometimes, the transfers are slow |

Stripe — best for large transactions

Stripe is an online payment processing system specialized for handling payments within an internet business.

Stripe payment processing time: It takes a couple of days

Stripe fees:

- 2.9% + $0.30 per card-payment transaction, and

- 2.7% + $0.05 for transactions on Stripe terminal.

Country availability: Available in 20+ countries

Currencies: Available in 135+ currencies

Payment methods:

- Credit Card,

- Debit Card,

- Bank Transfer, and

- Digital wallet.

Transfer limit: You schedule your money transfer dates to process automatically, with no official limit to the amount that can be transferred (the technical limit within the app is 999,999.99, regardless of the currency)

Notable features:

- Authentication and advanced fraud protection, including dispute handling,

- Dashboard for analysis purposes, and

- Consolidated and Financial reports.

| Stripe pros | Stripe cons |

|---|---|

| – Quick deposits – Excellent customer service | – Stripe integration requires developer expertise |

Western Union — best for international transactions

Western Union is a money transfer company that offers online payment and on-site payouts on over 500,000 worldwide locations.

Western Union payment processing time: Usually between 1–5 business days. You can always track your transfer, whether you’re the sender or the receiver.

Western Union fees:

Depending on the countries involved, bank fees, the transaction amount, agent location, and the payment method used. Here is the fee calculator that you’ll find useful when determining a transaction fee.

Country availability: Available in 200+ countries

Currencies: Available in 30+ currencies

Payment methods:

- Cash pickup,

- Bank transfer,

- Credit card,

- Debit card,

- The Western Union website,

- Over the phone, and

- In person at an agent’s station.

Transfer limit:

Depends on your transaction history, and whether you’re making a domestic or international transfer. If you conduct a payment at an agent station — there is no limit for how much you can send, but the amount you can receive is usually limited — and it depends on the agent’s station location.

Notable features:

- Backup for recipients who haven’t disclosed their ID,

- Advanced encryption technology, and

- Special ways for students and the military to receive payments.

| Western Union pros | Western Union cons |

|---|---|

| – Options for flexible transfers – Quick transfers of funds – Fantastic customer service – A Twitter account that alerts users to the latest frauds | – Negative currency exchange rates (can reach 20%) – Disclaimer — the disclaimer rids the company of all responsibility in case a customer doesn’t receive the money, which can sometimes be an agent’s fault |

MoneyGram — best for those who prefer multiple delivery methods

MoneyGram is another money transfer company that offers both domestic and international transfer — it’s mostly geared towards international transactions with over 360,000 on-site agent locations (over 25,000 in Africa alone).

MoneyGram payment processing time: Up to 24 hours, but for payments via online bank accounts it can take a bit longer — 3–4 days

MoneyGram fees:

Depending on the countries involved, the transaction amount, and the payment method — bank transfer requires lower fees, and a credit card or debit card require higher fees. There is a fee calculator right on the homepage to help you figure out the fees.

Country availability: Available in 200+ countries

Currencies: The sender can choose the currency

Payment methods:

- Cash pickup,

- Bank Transfer,

- Mobile Wallet account,

- Debit card,

- Home Delivery, and

- FastSend.

Transfer limit:

- For most countries, the limit is up to $10,000 per transaction,

- For the United States the limit is up to $15,000.

Notable features:

- Track the money transfer from send off to delivery,

- No need for an official bank account, and

- Payments carried out online or through agent locations.

| MoneyGram pros | MoneyGram cons |

|---|---|

| – Swift and secure transfers – You can conduct a transfer in person, using an app, or online – Huge agent network — more than 350,000 agents in 200+ countries and territories | – Fees are affected by destination, payment type, and transfer value – Not all payment options are accessible to everyone — for example, credit or debit cards cannot be used by senders from India to pay for their transfers |

Xoom (a PayPal service) — best for quick transfers

Xoom is an online international money transfer system (from the PayPal service family) that lets you send and receive money online in minutes and from either your desktop or mobile devices.

Xoom payment processing time: Takes minutes or sometimes up to a few days

Xoom fees:

- Bank account transactions cost between $0 and $10 — it depends on the amount being transferred and the currency, and

- The Credit and Debit Card transaction fee is a minimum of $1.99, but may be much higher, depending on the amount sent and countries involved.

Just to be on the safe side, you can always consult the Xoom fee calculator.

Country availability: Available in 30+ countries

Currencies: Available in USD, CAD, GBP, and EUR

Payment methods:

- Credit card,

- Debit card,

- Bank account transactions, and

- PayPal balance.

Transfer limit: $2,999/day for users that have a basic profile, and $50,000/day for verified users

Notable features:

- An anti-fraud verification system,

- Pay bills in Costa Rica, Dominican Republic, El Salvador, Guatemala, Honduras, Jamaica, Mexico and Nicaragua, and

- Instant updates on the status of your transaction.

| Xoom pros | Xoom cons |

|---|---|

| – Quick transfers – High transfer limitations ($50,000/day) for verified accounts – Low minimum transfer ($10) – Excellent customer service | – Xoom doesn’t offer a live chat support – You must validate your personal information — passport number, social security number, or driver’s license, if you want to transfer bigger amounts ($2,999 and up) |

Meta Pay — best for making payments via social networks

Facebook, Messenger, and Instagram are just a few social media platforms that Meta Pay enables you to utilize to send and receive money. You need to link a valid payment method to get started.

Meta Pay payment processing time: It usually takes 1–3 business days.

Meta Pay fees: In general terms, there are no fees, except for the transactions for personal fundraisers.

Country availability: Meta Pay is available in 160+ countries worldwide.

Currencies: Meta Pay is available in 55 currencies.

Payment methods:

- Credit and Debit cards, and

- PayPal.

Transfer limit: No transfer limit

Notable features:

- Information about bank accounts and credit cards is encrypted.

- For added security, you can set up a PIN or use the fingerprint or face identification feature on your mobile device.

| Meta Pay pros | Meta Pay cons |

|---|---|

| – Free and fast transfers – No need for the recipient’s bank account information | Customer service needs improvement |

FreshBooks — best for invoice-sending and expense-tracking

FreshBooks is a cloud-based accounting tool. You can easily create and track invoices using FreshBooks Payments.

FreshBooks fees:

- Credit card transaction fee — 2.9% + $0.30, except American Express — the fee is 3.5% + $0.30.

- Bank transfer fee — 1%.

Country availability: Available in over 120 countries.

Currencies: FreshBooks offers a multi-currency option.

Payment methods:

- ACH,

- Credit cards,

- Stripe, and

- Apple Pay.

Transfer limit: Depending on which plan you choose, you can send invoices to:

- 5 billable clients,

- 10 billable clients, or

- Unlimited number of billable clients.

Notable features:

- Time tracking feature,

- Invoices in multiple languages, and

- Payment Reminder option for your clients.

| FreshBooks pros | FreshBooks cons |

|---|---|

| – Excellent customer support – 30-day trial period – Outstanding invoicing service | – No quarterly income estimates – No payroll services |

What is the safest payment app?

As you can see, there are many payment apps you can choose from. Everybody wants to send and receive money safely and securely.

But, as you probably already know, the web is full of scammers just waiting for an opportunity to commit fraud.

According to a CNN team that tested several payment apps, two of the safest and most widely spread payment service providers are:

- Apple Pay, and

- Google Pay.

Rest assured that your money and card details will be safe with payment apps that enable QR codes or link sharing.

How to choose a payment processor?

When it comes to choosing a payment processor for accepting payments online, make sure you take into account:

- Transaction fees: how much it charges for each transaction,

- Processing time: how much time it needs to process payments,

- Country availability: whether you can receive payments in your country,

- Currency support: whether you can receive payments in your currency,

- Payment methods: whether it supports your preferred payment methods, and

- Transfer limit: how much money can you receive at once.

It’s typically the buyer or the client sending the money who pays for the payment processor’s services and fees, and not the receiver.

But, considering that the buyer or client will likely be looking for the most affordable option, make sure you do consider the transaction fees before suggesting a payment option (a more affordable solution will also increase your chances of getting paid properly).

How to include a payment option to your website

Once you’ve selected a payment processor, it’s best that you include it to your personal freelance website — remember, the easier the payment process, the more likely that clients will pay you on time.

Not all of the listed payment solutions are suitable for a website, but let’s look at how you can add PayPal to your website, as an example:

- First, procure and set up a Secure Socket Layer (SSL) to make sure all data is encrypted and protected,

- Once you have an SSL certificate, register your website with a digital authentication service — it will provide proof to you clients that your website is legit, and help you validate customer/client information as they enter it,

- Go to the list of available PayPal payment buttons,

- Select your button — the current options are the “Buy now”, “Add to cart”, “Donate”, “Subscribe”, “Gift certificate”, and “Automatic billing” buttons. For example, if you’re selling multiple items on your website, include the “Add to cart” button, and if your business sells only one item, include the “Buy now” button,

- Enter your name and the price for the service/item, and click “Create Button”,

- In order to select the button code, click on “Select code”,

- After clicking on “Select code” copy the code to your website, and

- Once you’ve included the button, you’ll be able to customize and edit it further on the “My saved buttons” page.

Now, your clients and customers will be able to securely pay for your products/services directly from your freelance website.

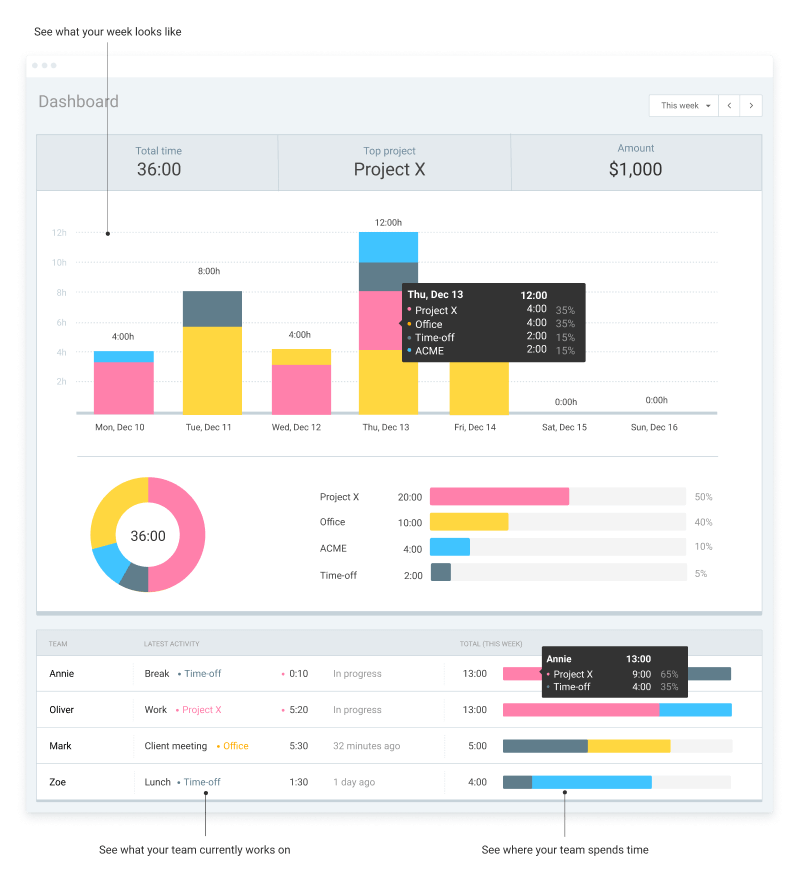

Bonus: keep track of your earnings with Clockify

Before you request payment from your client with a payment processor, you’ll first need to make sure you know exactly how much money you’ve earned — for this purpose, Clockify is an effective, free time tracker and time billing solution.

You’ll be able to:

- Add your hourly rates,

- Track the time you spend on tasks and projects, and

- Then have your exact earnings calculated automatically in Reports.

Later on, you’ll be able to save these Reports as links and send them out to your clients, so they can track your project progress in real time, as well as the amount of money they’re due thus far.

You’ll also be able to:

- Add 5 different types of hourly rates for you (and your freelance team), each more specific than the previous,

- Add time manually, for activities, projects, and tasks you forgot to add previously,

- Invite an unlimited number of team members to your workspace, for free,

- Receive automatic reminders to track time, in order to report the correct time you spent working and the correct earnings,

- Analyze, filter, and extract your time tracking data from Summary, Detailed, Scheduled vs Tracked, and Weekly Reports,

- Generate comprehensive PDF, CSV, and XLSX files based on your Reports, and

- When sending your client reports of the work you’ve accomplished (and the amount they’re due), you can brand your reports with your freelance business logo.

Wrapping up — The safest payment apps will enable quick and risk-free money transfers

Electronic payments have become customary for a quick, safe way to pay for nearly anything.

The best payment app should consider aspects like cost, transfer speed, and international presence. We briefly described the features of the safest payment apps and provided links to the websites of the corresponding apps so that you may learn more. We hope you’ll find the information provided useful when searching for the best payment app that suits your needs.

✉️ Are you a freelancer or a small-business owner willing to share your experience with the apps mentioned in this article? Or maybe you could recommend some other useful payment apps? Write to us at blogfeedback@clockify.me for a chance to be featured in this or one of our future articles. Also, if you liked this article, share it with someone else you know will find it useful.