Who pays for remote work expenses?

Last updated on: October 13, 2022

It might surprise you that, according to an Owl Labs study, nearly 16% of companies on a global scale are remote and nearly 35% of the population is working remotely. A lot of things have changed since 2020 and more and more people are looking to transition to working from home.

But, who covers the expenses associated with working from home? Namely:

- Who pays for the Internet?

- Who pays for the laptop/desktop computer?

- Who equips the remote home office with furniture?

- Who pays for a co-working space?

- And, if some of the remote work expenses are covered, do the remote employees take a pay cut as a result?

These are all vital questions to ask and answer — after all, remote work is no longer viewed as a benefit or reward only a select few can enjoy.

The number of fully virtual teams is on the rise and as much as 99% of traditional employees would love to work remotely in the future, to strike a better work-life balance.

What’s more, employers are more and more willing to introduce remote work as a fully-fledged work arrangement within their companies, as they believe it’ll reduce workplace stress.

In line with the prospective rise of remote employment, as well as its prospective benefits, here are the answers to all your burning questions about full-time remote work and its expenses — including some basic definitions of what remote work really means.

Table of Contents

What does remote work entail?

Remote employees or telecommuters are people employed by a company who carry out the bulk of their workload while working outside of a traditional office.

Remote workers may choose to work from a:

- Home office

- Coffee shop

- Co-working space

Some remote employees may even choose to work while traveling to distant cities and locations — they’re usually referred to as digital nomads.

Remote workers may be expected to work at the same time as their office-based peers.

But, most of them enjoy flexible working hours — either because they live in a different time zone than the rest of their colleagues, or because flexible work time is prescribed by the remote work policy of their companies.

In such a case, they are expected to meet a certain norm (e.g. 8 hours per day) — they track their time on work tasks to:

- Document their start and end times for the day, and

- Show what projects and tasks they’ve been working on.

Now, when working remotely, workers will likely still have a home office — unless they’re really active digital nomads — here’s what is needed for such an office.

What do you need for a telecommuting office setup?

Here’s the remote working equipment that each remote office needs:

- You’ll need proper furniture — no matter where you work remotely, you’ll need a desk, chair, and related furniture required for your job.

- You’ll need hardware for working remotely — this includes a mobile phone, a laptop/desktop computer, a second monitor, a printer, and every related technology you need to complete your assignments.

- You’ll need software for working remotely — this includes tools you need to use to carry out your main line of work, as well as the tools you use to communicate and collaborate with your team.

Now, so far, remote work and freelance work seem to largely overlap — so, what is the difference?

And, most importantly, how does this difference affect the question of remote work expenses?

What’s the difference between remote workers and freelancers, in terms of expenses?

Most freelancers are remote workers, but not all remote workers are freelancers.

The term “remote worker” is often tied to someone who’s employed in a company full-time.

The term “freelancer” is often tied to someone who’s hired to work on one (or more) short-term projects.

Moreover, freelancers cover their own remote work expenses (i.e. write them off as taxes).

On the other hand, the question of whether full-time remote workers or their employers cover the costs of the said remote work is a bit more difficult to answer.

Let’s start with the basics plaguing many who are considering a remote work arrangement.

Do remote workers get paid less?

Remote workers seem to enjoy a number of great perks. But, do the perks pay off, or do remote workers get paid less than their office-based counterparts?

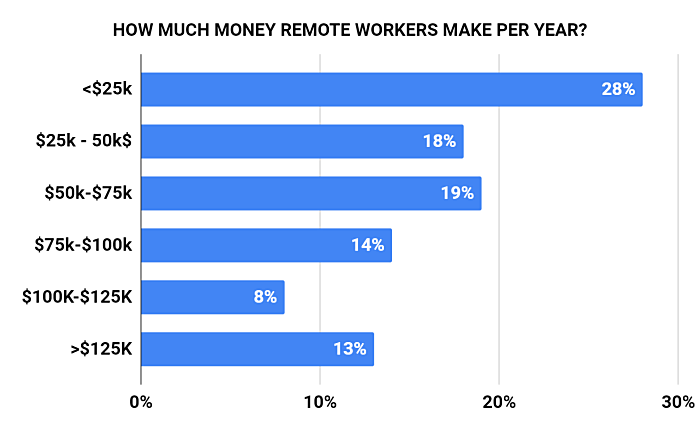

The answer depends.According to research made by Buffer in 2018, here’s how much money per year remote workers made:

As evident, the highest number of remote employees (28%) get paid less than $25K — with a total of 65% of remote workers who get paid less than $75K.

So, these numbers indicate that remote employees do get paid less than the more traditional workers.

On the other hand, as of Oct 4. 2022, studies performed by ZipRecruiter state that in the last 4 years, the annual average shifted by a huge margin. In actuality, remote workers nowadays earn as much as $62K per year, which amounts to $30 per hour — higher than the federal minimum wage and most state minimum wages in the US.

What are the key factors that determine remote work salaries/paychecks?

However, the factors that will determine your final paycheck largely depend on:

- The company you’re working for (1) — some may expect you to take a pay cut for your remote role and some simply won’t.

- Moreover, the question of whether remote employees get paid less is also tied to the industry of work (2).

- Another important factor is your location (3) — companies often define your yearly salaries based on the costs of living in your country or city.

So, someone living and working remotely from Kansas City will likely have a lower base salary than someone living and working from New York City.

In any case, no matter what the remote work policy prescribes, one research states that as much as 40% of employees would take a pay cut to work from home.

In fact, employees working for Facebook and Twitter have agreed in 2021 to a 20% pay cut in order to work from home. The percentage varies based on the expenses of the state they live in, but the premise remains the same — people love working remotely!

If you’re part of the 65% of remote workers who get paid less than $75K, bear in mind that these figures show the yearly salary without the money you save in the long run while working remotely.

How much can you save by working remotely?

According to research, Americans spend as much as $5,000 on commutes per year. They also spend extra money on professional wardrobe ($925), as well as restaurant lunches and branded coffee ($1,040).

That’s almost $7,000 you save by working remotely per year, right there.

Now, remote employees who get paid more than $75K can quickly make an enviable savings account out of their remote work arrangements.

And, if you’ve taken a pay cut to work remotely, remember that you may still make more than your office-based peers.

For example, if you take a $4,000 pay cut, but save $7,000 on various expenses, you’ll still be earning $3,000 more.

Now, let’s move on to the matter of who pays for the remote work expenses.

Who pays for what? — remote work expenses

Who really pays for remote work expenses?

In gist — the answer depends once again.

Some companies offer more to their remote workers, some offer less, and some even require the workers to cover their own costs and expenses.

Others provide their remote employees with access to a company computer (one they’ll most likely have to return when they move to a new job, of course).

Some companies even provide a stipend to cover the costs of a remote office.

In the following section, we’ll explore what may be included in your company’s remote work policy, based on some of the most common remote work reimbursement questions.

Who pays for the work equipment?

Work equipment includes all hardware and software you use to carry out your work.

This includes your:

- Internet connection,

- Laptop,

- Desktop computer,

- Monitors,

- PC peripherals,

- Cell phone, as well as

- The apps you use to facilitate work.

Who pays for the internet connection?

According to research that covered 1,900 remote workers from 90 countries, 79% of remote workers pay for their own internet connection.

To save money, many have claimed that they opt for affordable connection plans, which tremendously affects their work and connections during audio and video calls.

In truth, there is no wide-reaching federal law that requires the employer to reimburse internet expenses for their remote employers — only some states require employees to do so.

If your internet connection is crucial for you to carry out your work, you can discuss this with your supervisor, and maybe even get part of your internet fees covered by the company.

Interestingly, almost 30% of employees regarded that employers should be obligated to pay at least some of the internet bills, while 40% stated that employers should pay the entire internet bill.

After all, the research sample shows there are 22% of remote workers who do have their internet expenses covered — so, it’s not something unheard of.

Who pays for your laptop/desktop computer?

When it comes to the equipment that’s necessary for remote work, employers more than often provide their employees with laptops, desktop computers, and even cell phones, if the job requires it — e.g. sales positions, software developers, etc.

This probably has a lot to do with the fact that it’s in the interest of your employers that you have a reliable, secure, and fast machine to carry out your work on.

However, bear in mind that you probably won’t be able to get a company laptop if you’re working in a small business — due to a budget that’s probably limited.

Who pays for the software you use?

You’ll likely need a number of business-specific and more general tools to help you carry out your work and collaborate with colleagues remotely.

- If you’re a designer, you’ll likely need the Adobe Creative Cloud package, or a similar package — this includes Adobe Photoshop, Adobe Illustrator, and Adobe Animate, or their alternatives.

- If you’re a programmer, you’ll likely need a great editor system and database tools, among other tools.

- If you work in sales, you’ll likely need an efficient power dialer and marketing intelligence tool.

- You’ll likely need a strong audio and video conferencing system, for daily meetings and other arrangements, considering that you can’t meet with your clients and colleagues face-to-face on a regular basis. Alternatively, you can use a chat or communication app — such as Pumble — for this purpose.

- You’ll also need software that records the time you spend working, to make sure you document your work time correctly.

- You’ll likely also need project management tools or some similar software that helps you track project progress and collaborate with your other remote colleagues.

- If your company is supplying you with a laptop, you’ll probably already have these tools installed. Some of them will even be free, to begin with.

If you’re working on your personal laptop or desktop computer, your employer will likely still pay for your work software. As for the collaboration and project management software, the company will probably pay for a team plan — and you’ll be included.

💡 Clockify Pro Tip

Many tools your team will use for remote work come with a hefty price — but you don’t have to spend a fortune on tracking the time you spend working.

Try Clockify — our efficient time tracker for teams that allows your team to track time with a simple click and analyze the data to improve their efficiency.

Who pays for the additional equipment?

Additional work equipment may include:

- Printers,

- Scanners,

- Cell phones, and

- Multiple monitors.

The exact equipment you may need will depend on your industry and the job position you hold.

The chances you’ll have expenses covered for them depends on how crucial this equipment is for your work:

- When it comes to a cell phone, chances are you’ll be given one to carry out your work if you work in sales or any other position that requires you to make frequent phone calls.

- Unless printers and scanners are absolutely crucial for your work, you’re not very likely to get them.

- When it comes to multiple monitors, some types of professionals are more likely to get them than others. For example, if you’re a designer or programmer, your second monitor will be just as important for your work as the first one — accordingly, your chances that you’ll get one will significantly increase.

Later on, we’ll talk about reimbursement laws across the US, but we’d first like to single out California as one of the leaders in this sphere of law.

What is the California telecommuting law?

We’ve already mentioned that there is no wide-reaching federal law that requires employers to reimburse the equipment expenses of their remote employees — however, some states do have their remote work policies regarding work equipment clear.

For example, the matter of who pays for work equipment is legislated in California — through the California Occupational Safety and Health Act — COSHA.

According to COSHA, employers are required to make sure their employees are working in safe and healthy surroundings — no matter whether they’re remote or office-based. It also requires employers to reimburse their remote employees for all their work-related expenses.

This includes the remote workstations they create in their homes, as well as the internet fees, and tax deductions.

Moreover, according to the labor code 2802 cell phone law, remote workers who use their cell phones for work are entitled to be reimbursed for this time by their employers.

Who pays for your remote office?

When working remotely, you’ll likely work from home — in that case, it’s best that you have a home office equipped for that purpose.

However, you may also choose to work from a co-working place.

In any case, this may mean more expenses.

Some companies don’t cover these expenses, some cover these expenses to an extent — with a predefined home office stipend.

Let’s see how it all works in practice.

Does the employer pay for the remote home office?

According to research, as much as 82% of remote workers prefer to work from home — despite the popular image of remote workers who often travel and work from coffee shops.

This may have something to do with the fact that you can have some of your home office expenses covered — much easier than if you were to make other remote work arrangements.

Your employer may not be required by law to equip your home office, but he or she may need to make sure your office is “comfortable enough for your health”.

According to the Occupational Safety and Health Act, — OSHA — employers are not mandated to provide ergonomic chairs and workstations, but one General Duty Clause mandates the employers to keep the said workstations void of all hazards — and this includes “ergonomic hazards”.

In line with that, your company may provide you with an ergonomic chair, monitor stand, and similar tools to help keep your office ergonomic.

An increasing number of companies will even cover the costs of a stand-up desk or similar equipment meant to increase your productivity if you ask for it.

However, some companies may also implement an ergonomic program to make sure you’re aware of proper conduct in terms of ergonomics — and you’ll be the one to cover the expenses.

Again, it all depends on your company’s remote work policy.

💡 Clockify Pro Tip

Many people often think that working from home is a god-given privilege, but many disadvantages come with it. For some, it’s a lack of creativity and some struggle with finding the drive to stay productive.

Either way, the following blog on working from home will surely offer some tips on beating bad habits:

What is a home office stipend?

A home office stipend is the amount a company reimburses for the expenses of a remote home office. Interestingly, a home office stipend may cover more than just furniture — it will likely include your hardware and software.

You may be in a position to arrange a home office stipend that covers the costs of:

- Your work equipment,

- Your employee insurance,

- Renting your home office (if applicable),

- Your Internet, and

- Cell or home phone.

But, coming down with the exact figure for your stipend may be difficult — the price for quality ergonomic chairs begins at $200, and an average work desk is also priced at $200. The costs of software and hardware you’ll need depends on your job position and industry.

Depending on the company, you may be allowed to keep the said equipment after you leave your position at the said company — however, most companies will require you to return the stipend if you quit after a short time, say, several months.

If you get a home office stipend, you’ll always need to document your bills — however, if your arrangement says you’ll get reimbursed for business calls, you may not be reimbursed for electricity bills.

According to the Bring Your Own Device policy (BYOD), you may receive a mobile stipend that covers work-related calls you make from your home — this mobile stipend usually falls somewhere between $30 and $50 per month or $430 per year.

An Oxford Economics survey, 89% of companies provide at least a partial mobile stipend to cover phone expenses for their BYOD employees. What’s more, 58% cover at least connectivity stipend — this also includes device purchases.

If you have a great case about why working from home would benefit the business, you’ll be more likely to make arrangements for a home office stipend.

What is a home office tax deduction? And is working from home tax deductible?

Before 2018, if you used your home office strictly for business, you were in a position to deduct at least a portion of your home expenses for taxes.

For example, if the size of your home office is 300 square feet (roughly 28m2), the IRS would provide you with a $5 deduction for each square foot — which may build up to as much as $1,500 you’d be able to deduct for taxes on your home office space.

However, as of 2018 and until 2025, the home office tax deduction law is no longer applicable for people working remotely for companies — only for people who are self-employed, i.e. freelancers.

So, you can no longer deduct home office expenses for taxes.

Does the employer pay for co-working space?

According to many online surveys, only 8% of remote workers work from a coworking space.

Probably because the average cost of a coworking space in the US ranges from $195 to $387 per month, depending on the type of desk you want.

And, probably because a majority of remote workers have to cover the costs of a coworking space from their own pocket.

However, if you want to make a case for your co-working space in front of your employer, bear in mind that there are elements that may tip the scale in your favor.

For example, if you work from a remote part of the globe — instead of the nearby city where you can easily drive to your company’s offices if you want to enjoy a “more traditional working environment” — your employer may be more willing to cover the costs of a suitable co-working space.

If you want to make the case for your company covering your co-working expenses, explain that a co-working space would help you:

- Avoid the distractions of working from your home or a coffee shop,

- Always have a reliable internet connection,

- Be more productive overall,

- Install a dedicated business address for your company in the said co-working space, and

- Have a professional place to attend video conferences and video calls with clients.

Alternatively, you may need a co-working space to test out a new market in a new state or city — if your company sent you to a new city to test out the waters for your business without opening full-fledged offices, you’ll more than likely have all co-working expenses covered.

Who covers the other remote work expenses?

Despite being a remote worker, i.e. free of a daily commute to work, you’ll likely still need to travel at least a little for your business.

You’ll also need to consider whether you’ll get the same benefits as your office-based colleagues.

Does the company cover travel expenses for remote workers?

Yes, even remote workers have to travel to work from time to time — if they’re required to visit the company’s headquarters for whatever reason.

This will depend on your company’s policy, your industry or even the culture in the country where your company is based.

You may be required to come to the office once a month or a couple of times over the year.

Your company will likely cover your flight (if you have to fly in), hotel expenses, meals, and other types of transportation you need.

However, there are restrictions on the amount you can spend on each item — for example, you may be restricted to only spending $20 on each meal to qualify for full reimbursement of your meals.

Will you still have work benefits if you work away from the office?

Most remote workers get paid time off and sick leave just like their office-based counterparts — however, they may take fewer sick days — after all, commuting for 1 hour while sick is much less convenient than working from home while sick. It’s a matter of choice more than need.

When it comes to paid time off, some remote employees get unlimited paid time off — which entails a flexible amount of days per year you can use for your vacations.

Some companies even offer a travel stipend that lets you travel more — after all, you can work remotely, so they’re OK with you working remotely from various parts of the globe.

What are remote reimbursements laws and how do they help you?

When it comes to the US, things are a bit different, to say the least.

Namely, federal laws protect employees in terms of reimbursement for work-related expenses that sink their income below the federal minimum wage — $7.25.

In light of this, as many as 11 US states, and Washington D.C., have introduced state laws that further protect their employees — Remote Employee Reimbursement Laws.

The states that have implemented the reimbursement laws are:

- California,

- Illinois,

- Iowa,

- Minnesota,

- Massachusetts,

- Montana,

- New Hampshire,

- New York,

- North Dakota,

- South Dakota, and

- Pennsylvania.

The policies and laws regarding reimbursements differ based on the state, which is why it’s essential to check the state labor laws for further information.

However, an important question arises when employers are asked — What is a necessary expense?

If an expense is considered necessary — i.e. crucial to an employee’s performance — the states mentioned above will reimburse its employees in 99% of the cases.

Such cases could include:

- Internet bills,

- Carrier bills,

- Equipment,

- Office supplies, and

- Travel costs.

New York and California, the leading states in these policies, even offer reimbursement costs for electric bills and air-conditioning, in some cases.

In conclusion: What should you ask from your employer? And how?

As evident, the question of who covers the expenses of remote work — the employer or the employee — may depend on a lot of factors:

- It may depend on the industry you’re working in.

- It may depend on the job position you hold.

- It may depend on the work equipment you need.

- It may depend on the situation in your company.

- It may depend on the official remote work policy of your company.

- It may depend on the country or state where your company is located.

In any case, if you have any questions about your company’s remote work reimbursement policy or you want to present your arguments for a stipend to cover the costs of an important piece of equipment, you can discuss it with your operations manager or employer.

✉️ The future of work brings many challenges, but they’re not unattainable. All obstacles can be overcome, including work-related expenses. So, please share this with someone that might find it useful. And, if you know more information about this topic, share them with us at blogfeedback@clockify.me for a chance to be included in future posts.