How much does an employee cost?

Last updated on: June 13, 2022

When calculating employee costs for your new staff members, determining their salary/wage is just one part of the employment puzzle. In the private sector, the true cost of a new employee consists of obligatory taxes, as well as voluntary expenses, such as health and life insurance.

This article will guide you through all the details regarding:

- mandatory and non-mandatory payments and

- how to calculate the costs for salaried and hourly employees.

Table of Contents

How much does an employee cost?

Let’s say that you’ve set the desired pay for your new worker. In order to calculate the total costs for that employee, you’ll need to add the additional costs to his/her base salary/wage.

Note that there’s a difference between a salary and a wage. Thus, there are also salaried and hourly employees. Salaried workers receive a fixed amount of money per pay period. On the other hand, wage earners (hourly employees) are paid by the hour.

There are many factors that impact the full outlay of an employee. Some of these elements are:

- Location – your paycheck won’t be the same if you’re living in Miami and if you’re in New York City. Since costs of living are much higher in New York City than Miami, your wage/salary would have to be higher in New York City, too. Check out this handy cost of living calculator from CNN and test it yourself.

- Industry sector and preferred skills for that industry.

- Education and experience levels.

- Company size.

- Job tasks and your performance.

💡Employee’s performance is a helpful factor because it helps you calculate the value that employee brings to your company, as well as to figure out employee productivity. Find out more from this blog:

Joe Hadzima, a Senior Lecturer at MIT, came up with the idea of how to calculate the total employee costs. In his opinion, the typical costs of an employee are usually between 1.25 to 1.4 times more than their base income. So, you can multiply the base income by 1.25 or by 1.4 to figure out the minimum and maximum outlay.

There are certain differences between labor costs for salaried and hourly employees. That is why we’ll first explain all necessary and voluntary expenses for salaried employees. After that, we’ll cover the payments for hourly employees.

For salaried employees

First, let’s see which expenses are necessary and which are non-compulsory for salaried workers.

Mandatory expenses

If you’re a business owner, be sure that these are the taxes that you have to pay for your new salaried employee:

- Federal Insurance Contributions Act (FICA tax) for Social security,

- FICA tax for Medicare,

- Federal & Unemployment Insurance Tax – (FUTA) tax,

- State Unemployment Insurance (SUTA) tax, and

- Workers’ compensation insurance.

Now, we’ll dive into more details about each of these expenses.

Federal Insurance Contributions Act (FICA) taxes – Social security and Medicare

FICA taxes include:

- Social security taxes and

- the hospital insurance taxes – Medicare.

When it comes to Social security taxes, the current rate is 6.2% for the employer and 6.2% for the employee (12.4% total). Besides, there’s a wage base limit for Social security. According to the IRS, the wage base limit is “the maximum wage that’s subject to the tax for that year”. For payments in 2020, this limit is $137,700.

Speaking of Medicare taxes, the current rate for these expenses is 1.45% for the employer and the same percentage for the employee (2.9% total). Unlike the Social security taxes, there’s no wage base limit for Medicare.

Federal and Unemployment Insurance tax – (FUTA) tax

Regarding the FUTA tax, the employer is required to pay 6% for the first $7,000 the employee has earned. Many companies choose to cover these expenses on an annual basis, which is $420 in total.

But, there’s also an exception. In California, employers/companies have to pay 2.1% or $147 annually.

State Unemployment Insurance (SUTA)

When it comes to SUTA taxes, this expense is different for each state. In general, it can be between 2.7% and 3.4%.

However, there are certain states with lower tax rates for SUTA. For example, in Nebraska the rate is 1.25%. But, these percentages can get higher than 3.4%. For instance, in Minnesota, this tax rate goes from 1% to 8.9%.

The employers pay for SUTA, but in Alaska, New Jersey, and Pennsylvania, SUTA is partially accumulated from an employee’s wages.

Also, there’s a separate rate for new employers and for experienced employers. Take a look at more details about SUTA taxes in your state.

Workers’ compensation insurance

Another required tax is the Workers’ compensation insurance. The purpose of this payment is to insure employees against work-related injuries. Each type of job has its own rate for every $100 of wage/salary.

Since particular jobs are riskier than others, industries like landscaping will have a higher rate – $6.94, than jobs that take place in an office – $0.12.

Now, let’s take a closer look at the non-required payments.

Non-mandatory expenses

Many companies choose to provide their staff with some additional benefits. If you’re considering these options for your employees, here’s the list of the most common voluntary expenses:

- Health and dental insurance

- Paid Time Off (PTO)

- Life insurance

- Long-term disability insurance

- Retirement savings or 401(k) Plan.

Health and dental insurance

While Medicare is a compulsory expense, health insurance is a voluntary payment. This insurance is among the highest of all benefits. The above-mentioned Joe Hadzima gave an example of this expense. So, if an employee makes $50,000 a year, his/her health insurance will be between $2,000-$3,000 (single employees) and $6,000-$7,000 (for families).

Speaking of dental insurance, this payment depends on the number of employees, the type of insurance, and the location of your company. According to Hadzima, the average dental insurance will be from $240 to $650.

Paid Time Off (PTO)

Paid Time Off (PTO) is a policy that covers:

- vacation time,

- sick leave,

- personal time,

- federal holidays,

- family leave,

- maternity and paternity leave.

Based on the regulation by the Fair Labor Standards Act (FLSA), this policy is not obligatory in the U.S. But, many companies include PTO as one of their employee benefits.

If this applies to your company, be sure to create a practical system for scheduling PTO. In fact, try using a free PTO tracker. This way, your employees can request their time off, and then you can approve it. Furthermore, you’ll be able to see who is currently using their time off in the weekly report.

Life insurance

Life insurance is a policy that can be significant both for the employees and their families. This policy provides financial security for the family of an employee, in case of his or her death. It’s important to clarify that the insurance covers the case of an employee’s death only if the death is not due to his/her fault.

When it comes to life insurance, Joe Hadzima says that the average outlay is around $150 on the first $50,000 of your wages.

Long-term disability insurance

Long-term disability insurance (LTD) is a policy that insures employees in case of an illness, injury, or an accident. If any of these events happen, the employee will still receive a percentage of an income. But, LTD insurance does not cover work-related accidents, since these are included by the Workers’ comp insurance.

Before an injured employee starts obtaining LTD insurance, he/she will first receive the short-term disability insurance (STD). The STD insurance usually lasts from three to six months. After this period, an employee will get a certain percentage of the salary, usually 50-70 percent, due to LTD.

As for the employer who provides this insurance to his/her employees, Hadzima claims that the average amount of a long-term disability insurance is $250, for a wage of $50,000.

Retirement savings or 401(k) Plan

In the private sector, the 401(k) Plan is a retirement account that employers can set for their staff. Employees can choose if they want their employer to contribute a part of an employee’s salary to an individual account (under this plan).

Employers can manage the 401(k) Plan themselves, or they can hire a professional to handle this payment. Usually, companies hire a bank, a mutual fund provider, or an insurance company, to run the Retirement savings.

According to CNN’s reporter Jose Paglieri, the average contribution to the Retirement savings plan is 2.5% of a worker’s salary.

To sum up, we’ve collected all obligatory and non-obligatory expenses for salaried employees in one place. Take a look at the table below to better understand the payments you’ll have to make for a new employer.

| Mandatory costs | Non-mandatory costs | |

| 1 | FICA (Federal Insurance Contributions Act) Social security | Health and dental insurance |

| 2 | FICA Medicare | Paid Time Off (PTO) |

| 3 | Federal Unemployment Tax Act (FUTA) | Life insurance |

| 4 | State Unemployment Tax Act (SUTA) | Long term disability insurance |

| 5 | Workers’ compensation insurance | Retirement savings or 401(k) Plan |

These are all expenses for your salaried workers. Now, let’s examine the payments for hourly employees.

For hourly employees

As stated by the U.S. Department of Labor, labor cost for hourly employees is “the sum of total compensation and overhead cost”.

Total hourly compensation consists of wages and non-wage benefits.

As we mentioned above, wage is not a fixed amount of money. Wage is a payment that an individual gets based on the number of hours spent working. Thus, it’s vital that hourly employees monitor their working hours by using a time clock app. In addition, employers can arrange an employee clock-in clock-out system for all workers.

Non-wage benefits cover:

- Paid leave: vacation, holidays, and sick leave.

- Supplementary pay: including premium pay for overtime and work on holidays and weekends, shift differentials, and non-production bonuses.

- Retirement: defined benefit and contribution plans.

- Insurance: life insurance, health benefits, short-term and long-term disability.

- Legally required benefits: Social security and Medicare, federal and state unemployment insurance taxes, and Workers’ compensation insurance.

💡Learn how you can use Clockify to track employee overtime:

As for the overhead, here’s how the DOL defines it:

“Overhead costs are not related to direct labor or direct materials and they must be paid on an ongoing basis regardless of the output of a firm”.

In other words, overhead is related to production costs. Thus, overhead has to be a part of the labor cost estimates.

To summarize, legally required payments for hourly employees are those five taxes, just like with the salaried employees. But, besides these taxes, overhead payments are also compulsory when doing labor cost estimations. Check out our table below.

| Labor costs for hourly employees | |||

| 1 | Total hourly compensation | Wage + non-wage benefits: | |

| Legally required benefits | Other benefits | ||

| FICA (Federal Insurance Contributions Act) Social Security | Paid leave | ||

| FICA Medicare | Supplementary pay | ||

| Federal Unemployment Tax Act (FUTA) | Retirement plan | ||

| State Unemployment Tax Act (SUTA) | Insurance | ||

| Workers’ Compensation Insurance | |||

| 2 | Overhead | ||

You might be wondering how to calculate these expenses for your employees. We’ll explain this issue in the following section.

How to calculate the cost of an employee?

As we’ve mentioned earlier, there’s a difference between salaried and hourly employees. Along with this difference, the payments for an employee won’t be the same if he/she receives a salary (salaried employees) or a wage (hourly employees). Thus, we’ll show you the examples for the salaried workers and the total employee expenses you would have. Furthermore, we’ll also show you the example for the hourly workers and the outlay you’d have to pay for them.

For salaried employees

We’ll give you three examples of covering expenses for salaried employees:

- How to determine mandatory expenses,

- how to determine non-mandatory expenses, and

- Base salary plus mandatory and non-mandatory expenses.

How to determine mandatory expenses?

First, we’ll calculate all the compulsory annual payments that are added to a base salary. Here are these payments:

- FICA Social security – the rate is 6.2% for the employer.

- FICA Medicare – the current rate for Medicare is 1.45% for the employer.

- Unemployment insurance FUTA – the rate is 6.0% of the $7,000 first that you compensated to your employee as wages.

- Unemployment insurance SUTA – each state has its own rate for SUTA taxes.

- Workers’ compensation insurance – this insurance depends on the type of job and its level of risk.

So, as an example, we’ll use an office worker, who has a Workers comp rate of $0.12 (for each $100 of the wage). To show you how SUTA tax varies from state to state, we’ll use South Dakota, a state with very low SUTA rate for new employers – 0.55%. On the other hand, we’ll take Wisconsin as one of the states with higher SUTA rates – 3.05% for new employers.

Since we wanted to calculate the realistic income of South Dakota and Wisconsin employees, we checked this data on CNN’s cost of living calculator. Here’s the result: if a South Dakota worker has an annual salary of $50,000, the comparable salary of a Wisconsin worker would be higher – around $58,000, due to higher costs of living.

Here are the details for Henry – a South Dakota office worker with an annual salary of $50,000. Henry lives in Sioux Falls, which is the most populous city in South Dakota.

| Type of mandatory expense | Percentage of employee’s base salary | Base salary ($50,000) |

| FICA Social security | 6.20% | $3,100.00 |

| FICA Medicare | 1.45% | $725.00 |

| Unemployment insurance FUTA | 6% of first $7,000 | $420.00 |

| Unemployment insurance SUTA | 0.55% in South Dakota (for new employers) | $275.00 |

| Workers’ comp | $0.12 for each $100 of wages | $60.00 |

| Total | $4,580.00 |

This is the total amount that Henry’s employer has to pay for Henry’s compulsory taxes. Now, let’s take a look at another example.

Here are all the details for Eleanor – a Wisconsin office worker with an annual salary of $58,000. Eleanor lives in Milwaukee, the most populous city in Wisconsin.

| Type of mandatory expense | Percentage of employee’s base salary | Base salary ($58,000) |

| FICA Social security | 6.20% | $3,596.00 |

| FICA Medicare | 1.45% | $841.00 |

| Unemployment insurance FUTA | 6% of first $7,000 | $420.00 |

| Unemployment insurance SUTA | 3.05% in Wisconsin (for new employers) | $1,769.00 |

| Workers’ comp | $0.12 for each $100 of wages | $69.60 |

| Total | $6,695.60 |

This is the total costing that Eleanor’s employer has to pay for her compulsory taxes.

How to determine non-mandatory expenses

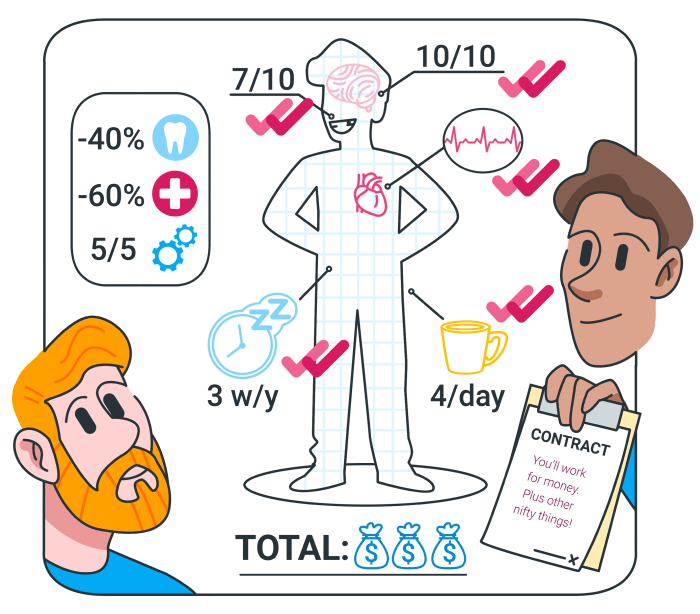

When it comes to optional costs, Joe Hadzima points out that typical annual benefits for a salaried employee with an annual salary of $50,000 would be:

- For health insurance: $2,000-$3,000 for single persons, $6000-$7200 for families,

- For dental insurance: $240-$650,

- For life insurance: $150,

- Long-term disability insurance: $250, and

- 401(k) plans: as Jose Paglieri says, this would be 2.5% of a worker’s salary.

To make these numbers more realistic, we’ll use Henry as an example. As we’ve seen from the previous example, Henry makes $50,000 per year.

Henry has a family, so he’s eligible to receive health insurance for his family, too. Let’s say that his company decided to set up Henry’s health coverage to $6,500 and his dental insurance to $550.

| Type of non-mandatory expense | The amount of benefit (out of $50,000) |

| Health insurance | $6,500.00 |

| Dental insurance | $550.00 |

| Life insurance | $150.00 |

| Long-term disability insurance | $250.00 |

| 401(k) plan (2.5% of salary) | $1,250.00 |

| Total | $8,700.00 |

This is the total amount of benefits that Henry’s employer has to pay for Henry, based on his annual salary.

Base salary plus mandatory and non-mandatory expenses

Finally, we’ll sum up the base salary from our example with Henry, along with all obligatory and non-obligatory expenses. So, here are elements of the following table:

- Henry’s base salary, per year: $50,000.

- Mandatory expenses for Henry: $4,580.

- Non-mandatory expenses for Henry (benefits), a total of: $8,700.

| Amount | |

| Base salary | $50,000.00 |

| Mandatory expenses | $4,580.00 |

| Non-mandatory expenses (benefits) | $8,700.00 |

| Total | $63,280.00 |

Although Henry’s base salary is $50,000, his employer would have to pay much more for this employee. In fact, the sum of all Henry’s required and voluntary payments, that his employer has to cover is:

$63,280 – $50,000 = $13,280.

In brief, this is how you calculate the payment for a salaried employee. However, if you’re interested in making estimates for an hourly worker, you’ll find all the details in the next part of this blog.

For hourly employees

As we’ve already mentioned, labor costs for hourly workers include:

- Legally required taxes (Social security, Medicare, federal and state unemployment insurances taxes, and Workers’ compensation insurance) and

- Overhead.

Additionally, you can add other non-wage benefits, such as paid leave, supplementary pay, insurance, retirement plan.

But, in order to calculate the total labor costs for an hourly employee, we have to take into account the following elements:

- Total hours worked per year and annual employee labor cost, as well as

- annual overhead per employee, and

- annual taxes per employee.

So, let’s get started.

Total hours worked per year

To get the total number of hours worked per year, we need two components:

- Average hours worked per employee per week and

- weeks worked per year, which can be from 1-52.

When it comes to hourly workers, it’s vital to track employee hours, which your employees can do themselves. Once you have their weekly working hours, you would easily calculate their total hours worked per year.

Here’s an example. Let’s say that you run a business in Phoenix, Arizona. Your hourly office worker tracks 40 hours per week. In total, this employee works 50 out of 52 weeks per year. Now, we’ll multiply the average hours worked per week by the weeks worked per year.

40 × 50 = 2,000

So, the total hours worked per year are 2,000.

Annual employee labor cost

To calculate the annual employee labor cost, we need to multiply two elements:

- Employee hourly rate and

- Annual hours worked.

If an hourly worker earns $15 per hour and has 2,000 annual hours worked, here’s how we’ll get the annual employee labor cost:

$15 × 2,000 = $30,000

The annual employee labor cost here is $30,000.

Annual overhead per employee

Annual overhead contains the following expenses:

- Annual building costs,

- annual property taxes,

- annual utilities,

- annual equipment and supplies,

- annual insurance paid, and

- annual benefits paid.

Once you’ve added all these expenses, you need to divide this number by the number of employees. This way, you’ll get an annual overhead per employee.

Let’s say that the annual overhead is $9,000 per year. If there are 60 employees in the company, we’ll divide $9,000 by 60.

$9,000 ÷ 60 = $150

So, the annual overhead per employee is $150.

Annual taxes per employee

Just like with salaried employees, annual taxes for hourly employees need to cover:

- Annual FICA Social security tax,

- annual FICA Medicare tax,

- annual FUTA tax,

- annual SUTA tax, and

- Workers’ compensation insurance.

To calculate these taxes, we need to multiple the annual employee labor cost by the percentage of each tax. In the case of an Arizona office worker who makes $30,000 per year, here’s what these expenses would be.

| Annual employee labor cost | Type of expense and percentage of an annual labor cost | Total |

| $30,000 | FICA Social security tax – 6.2% | $1,860.00 |

| $30,000 | FICA Medicare tax – 1.45% | $435.00 |

| $30,000 | FUTA tax – 6% for the first $7,000 | $420.00 |

| $30,000 | SUTA tax – in Arizona, 2.0% for new employers | $600.00 |

| $30,000 | Workers’ comp – 0.12% (for an office worker) for each $100 of wages | $36.00 |

| Total expenses | $3,351.00 |

As we can see from the table above, the total expenses of annual taxes for this employee would be $3,351.

The final cost of an employee per hour

In order to determine the real cost of an employee per hour, we need to sum the payments that we’ve already calculated:

- Annual employee labor cost – $30,000,

- annual overhead per employee – $150, and

- annual taxes per employee – $3,351.

Once we get the sum of these three expenses, we’ll divide that number by the total hours worked per year.

$30,000 + $150 + $3,351 = $33,501

$33,501 ÷ 2,000 = $16,75

Although this employee earns $15 per hour, his/her employer has to pay exactly $16,75 for the labor cost per hour.

We have to point out that this number includes only involuntary expenses that the employer is required to pay. However, if you add optional expenses, the true labor of an employee per hour might change.

Wrapping up

As a business owner, bear in mind that the labor costs of new employees involve a lot more than just a paycheck. Besides a base salary/wage, there are particular obligatory expenses that you would have to pay for new staff members. Furthermore, you should provide your employees with some voluntary payments (benefits), such as health insurance. That way, your company will be more appreciated by potential employees.

Whether your employees are salaried or hourly, you’ll need to calculate labor costs differently. If you’re struggling with making the employee cost estimates, be sure to follow the steps we explained in the article.